STUTTGART — Robert Bosch GmbH (Bosch) has unveiled plans for its venture capital subsidiary, Robert Bosch Venture Capital GmbH (RBVC), to initiate a new €250 million fund dedicated to supporting startups globally. With a focus on advancing technologies that enhance quality of life and environmental sustainability, Bosch aims to foster innovation and collaboration within the startup ecosystem, according to a press release published on EuropaWire.

Dr. Stefan Hartung, chairman of the board of management of Robert Bosch GmbH, highlighted the significance of investing in startups as a catalyst for technological progress in both business and society. The venture capital fund aligns with Bosch’s commitment to climate-neutral technology, sustainable mobility, and connectivity, reinforcing its leadership in addressing pressing global challenges.

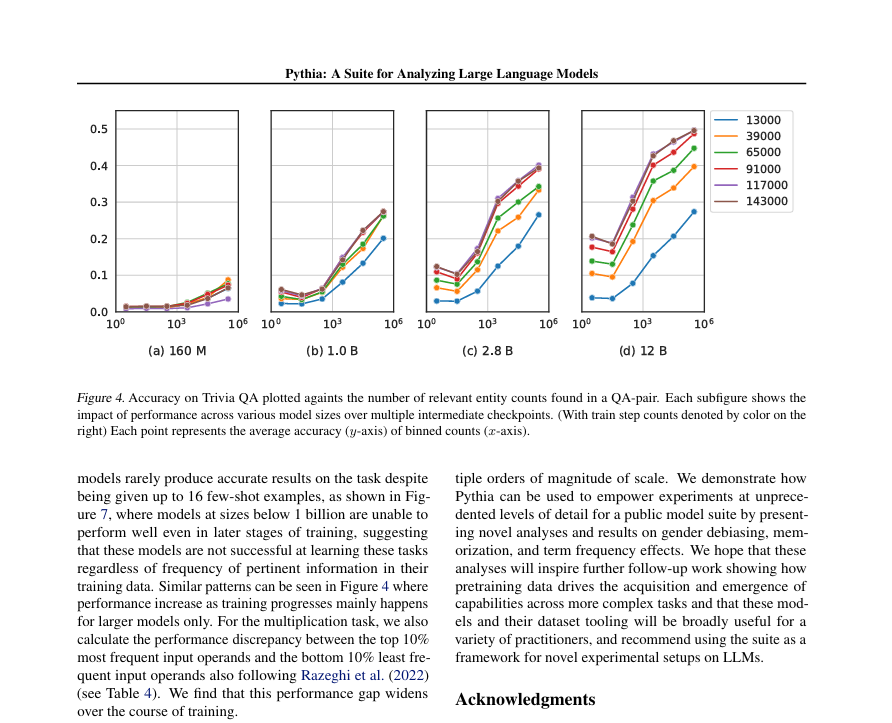

RBVC’s extensive portfolio spans diverse sectors such as artificial intelligence (AI), the Internet of Things (IoT), semiconductors, and quantum computing. By investing up to €25 million in individual startups and providing strategic support, RBVC leverages Bosch’s expertise to accelerate the development and deployment of innovative solutions. With over 50 companies in its portfolio, RBVC is poised to drive meaningful impact in emerging technology markets.

In line with its expansion strategy, RBVC will establish a second office in the United States, complementing its existing presence in Sunnyvale. This strategic move underscores RBVC’s commitment to engaging with technology startups and identifying disruptive innovations that shape industries globally.

Dr. Ingo Ramesohl, managing director at Robert Bosch Venture Capital GmbH, emphasized the importance of staying attuned to technology trends and geopolitical shifts. RBVC’s rigorous selection process ensures that only the most promising startups receive investment, with a keen focus on addressing evolving market dynamics and challenges.

RBVC’s proactive approach to fostering innovation through its Open Bosch program facilitates collaboration between startups and Bosch operating units, driving mutual benefits and technological advancements. By nurturing partnerships with startups, Bosch enhances its access to cutting-edge technologies, reinforcing its position as a leader in technological innovation.

RBVC’s track record of successful investments, including IPOs of companies like Xometry and IonQ, underscores its commitment to driving technological progress and supporting startups on their growth journey. With investments spanning electromobility, genetic testing, and fleet management, RBVC remains at the forefront of shaping the future of technology.

As Bosch continues to invest in climate-neutral technology and digital transformation, RBVC’s latest fund signals a renewed commitment to driving innovation and sustainability in partnership with startups worldwide.