ALCOBENDAS – In a bid to fortify cybersecurity measures and enhance customer experience, Minsait, an Indra company, and Bankia have forged a strategic alliance to develop cutting-edge AI-based tools. These tools are geared towards thwarting fraudulent activities and detecting cybersecurity anomalies across financial institutions and businesses in various sectors, according to a press release published on EuropaWire.

The surge in digital transactions coupled with the imperative to bolster security in online transactions, contactless payments, and domestic and international transfers has underscored the need for robust cybersecurity measures. The partnership between Bankia and Minsait seeks to address these challenges by harnessing the power of artificial intelligence to preempt, detect, and contain fraudulent activities effectively.

Drawing on a blend of algorithms, intelligence, and historical data from both entities, the collaboration aims to create an anti-fraud solution equipped with rapid response capabilities. This solution, bolstered by the expertise of SIA, a leading cybersecurity firm recently acquired by Indra, promises to revolutionize fraud prevention in the banking sector and beyond.

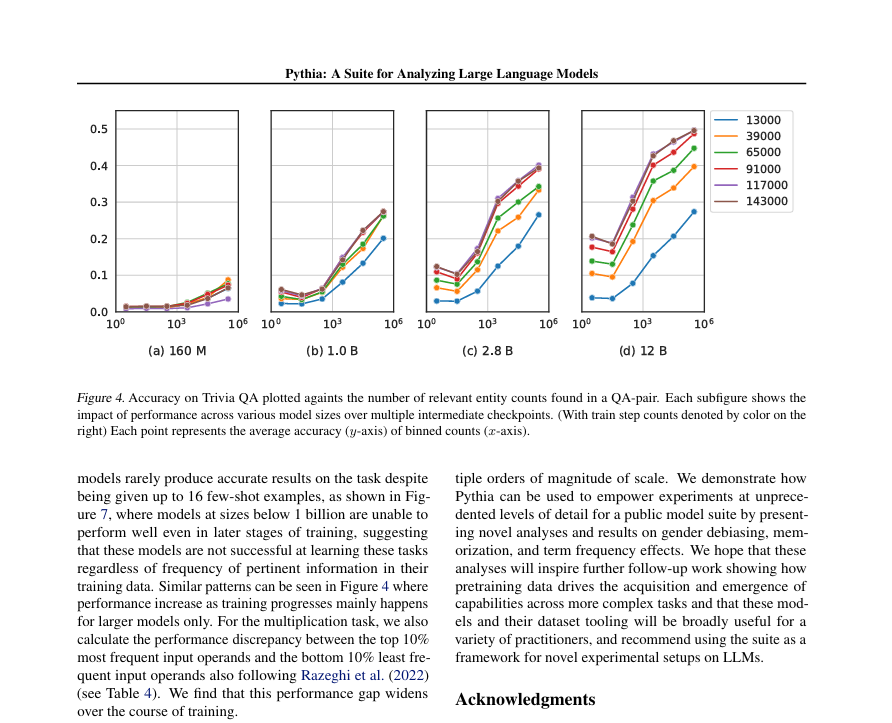

Utilizing machine learning techniques, neural networks, and in-memory computing processing, the solution will deploy detection engines capable of identifying known fraud patterns, uncovering unknown fraud patterns, and detecting deviations from expected behaviors. By leveraging dynamic learning mechanisms, the solution goes beyond static rule-based engines traditionally employed in the banking sector.

Furthermore, the partnership extends to anomaly detection in cybersecurity environments, leveraging AI and machine learning within a Big Data framework. This approach enables the identification of illicit actions and unexpected deviations, thereby minimizing false positives and enabling swift responses to critical anomalies.

Beyond enhancing security measures, the collaboration aims to drive cost reduction for financial institutions and companies by streamlining fraud detection, prevention, and management processes. Notably, the solution, tailored for the Spanish market, is poised for global scalability, epitomizing a commitment to responsible digitalization and fraud prevention on an international scale.

This agreement underscores the ongoing collaboration between Minsait and Bankia in the realm of digital transformation. With recent milestones such as the implementation of a video-identification solution enabling seamless “digital onboarding” of Bankia customers, the partnership continues to drive innovation in enhancing customer experience and security within the financial sector.