MUNICH – Munich Re, a global leader in reinsurance, is at the forefront of innovation once again, unveiling a suite of digital solutions poised to transform the insurance landscape. Leveraging the power of data analytics and artificial intelligence (AI), Munich Re aims to expedite claims estimates, enhance risk assessment accuracy, and fortify loss prevention strategies.

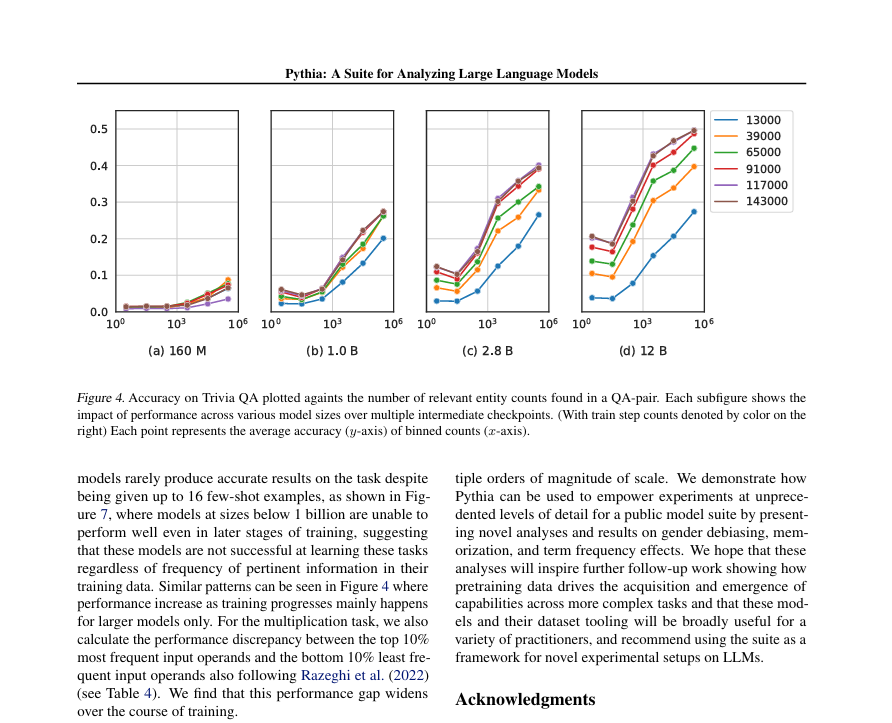

In an era where AI and data analytics are reshaping risk management paradigms, Munich Re’s experts amalgamate primary insurers’ portfolio data with external datasets encompassing factors like site geography, construction details, weather patterns, and socio-economic indicators. By applying machine-learning principles, Munich Re can unearth latent risk drivers, enabling proactive measures such as tailored loss prevention strategies and optimized pricing structures.

Doris Höpke, Member of the Board of Management at Munich Re, underscored the significance of these digital innovations, stating, “Our commitment at Munich Re is to pioneer digital solutions for the insurance industry. Through substantial investments in data analytics and AI, we’re empowering our clients with novel methodologies and product offerings. This translates into expedited claims processing, heightened risk assessment accuracy, and ultimately, superior loss prevention measures.”

One standout example of Munich Re’s digital prowess is “The Box,” a groundbreaking solution within the motor insurance sector. By harnessing the predictive capabilities of machine learning, “The Box” enables precise estimation of anticipated damages. When augmented with external data sources such as weather conditions and accident statistics, the accuracy of loss estimates is further bolstered, consequently driving down loss ratios. The automation inherent in “The Box” streamlines pricing processes for primary insurers, substantially reducing operational costs.

In another pioneering initiative, Munich Re introduces “AQUALYTIX” to combat water-mains damage, a perennial challenge in residential-building insurance. Integrating primary insurers’ portfolio data with external insights, Munich Re employs machine learning algorithms to pinpoint risk factors at the individual building level. This proactive approach enables primary insurers to refine portfolio management strategies, thereby mitigating losses and improving overall loss ratios.

The advent of big data and its transformative impact on various industries, including insurance, is undeniable. Munich Re, cognizant of the evolving risk landscape, initiated its TechTrend Radar in 2015, providing invaluable insights into emerging tech trends and their implications for the insurance sector.

With its unwavering commitment to innovation and technological advancement, Munich Re continues to spearhead transformative initiatives that redefine the boundaries of the insurance industry, setting new standards for efficiency, accuracy, and risk management.