Key Points

- CoreWeave, an AI hyperscaler, has acquired Weights & Biases, an AI developer platform, in a deal valued at about $1.7 billion, expected to close by mid-2025.

- The acquisition aims to combine their strengths to enhance AI development, maintaining W&B’s interoperability with multiple cloud providers.

- Media reactions are mostly positive, seeing it as a strategic move for both companies, especially ahead of CoreWeave’s IPO.

SAN FRANCISCO — On March 4, 2025, CoreWeave, a prominent AI hyperscaler known for its cloud infrastructure, announced its acquisition of Weights & Biases (W&B), a leading AI developer platform. This move, valued at approximately $1.7 billion and expected to close in the first half of 2025, marks a significant consolidation in the AI industry, aiming to create an end-to-end platform for AI innovation. Given the current date, March 18, 2025, the deal is still pending regulatory approvals, with implications for both companies’ future growth, especially as CoreWeave prepares for its initial public offering (IPO).

Company Backgrounds

CoreWeave, established in 2017, initially focused on providing GPU computing power for cryptocurrency mining. It has since pivoted to serve the AI sector, offering scalable infrastructure for major AI companies and research institutions. This shift positions CoreWeave as a critical player in supporting AI workloads, leveraging its expertise in graphics processing units (GPUs).

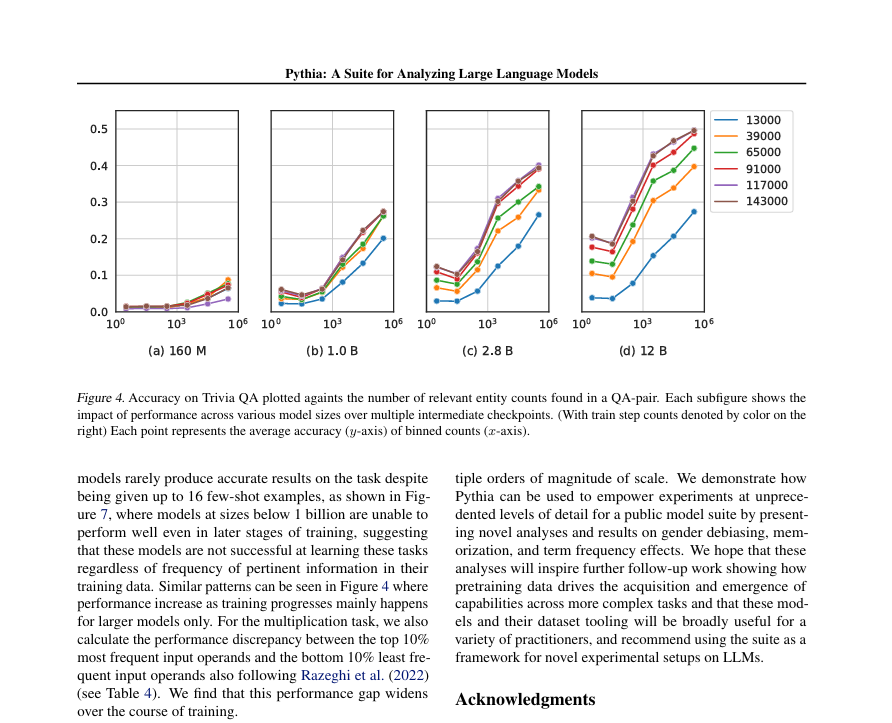

Weights & Biases, also founded in 2017, has rapidly become a staple in the AI development community. It serves over 1 million AI engineers and more than 1,400 organizations, including industry giants such as OpenAI, Meta, Nvidia, and Toyota. W&B’s platform offers tools for experiment tracking, model fine-tuning, and deployment monitoring, making it essential for machine learning operations (MLOps) and large language model operations (LLMOps).

Details of the Acquisition

The acquisition, announced via CoreWeave’s blog (CoreWeave Blog) and corroborated by multiple media outlets, is valued at around $1.7 billion, a premium over W&B’s 2023 valuation of $1.25 billion. The deal is expected to close in the first half of 2025, pending regulatory approvals, as noted in reports from Maginative (Maginative) and others.

Michael Intrator, CEO of CoreWeave, emphasized the strategic fit, stating, “This acquisition will be a gamechanger for our customers and the AI market at large, solidifying our position as the AI Hyperscaler™, from compute to model management to AI application evaluation and monitoring.” Lukas Biewald, CEO of W&B, echoed this sentiment, noting, “We are proud to join forces with CoreWeave, a company that shares our passion for supporting the AI research community and delivering high-quality products. Together, we can unlock new levels of innovation at the intersection of hardware and software.”

A key aspect of the deal, as confirmed by the official press release, is CoreWeave’s commitment to maintaining W&B’s interoperability. This ensures that W&B customers can continue deploying workloads on-premise or with their chosen infrastructure provider, preserving flexibility for users. This detail, found in the CoreWeave blog, addresses potential concerns about vendor lock-in and supports a seamless transition for existing users.

Media and Industry Reactions

Third-party media outlets have largely viewed the acquisition positively, focusing on its strategic implications. TechCrunch (TechCrunch) reported the deal, noting CoreWeave’s Nvidia backing and IPO preparations, with The Information estimating the value at $1.7 billion. This coverage highlights the acquisition as a strengthening move for CoreWeave’s position in the AI cloud market.

SiliconANGLE (SiliconANGLE) emphasized the integration of W&B’s development tools with CoreWeave’s infrastructure, suggesting it could attract a broader customer base beyond hyperscale clients like Microsoft and Meta. This integration is seen as offering a more comprehensive “end-to-end” AI experience, potentially accelerating AI roadmaps.

Maginative (Maginative) underscored W&B’s critical role in modern AI workflows, serving organizations like OpenAI and AstraZeneca, and suggested the acquisition will diversify CoreWeave’s offerings ahead of its IPO. PitchBook (PitchBook) framed the deal as a significant event for W&B’s early investors, including Trinity Ventures and Coatue Management, noting the $1.7 billion price tag as a markup from its prior valuation, beneficial in a slow IPO market.

Reuters (Reuters) and analyticsindiamag.com (analyticsindiamag.com) also covered the deal, reinforcing the narrative of enhanced AI capabilities and market positioning. No significant negative reactions were found, suggesting broad industry support.

An X post from W&B’s official account (W&B X Post) on March 5, 2025, expressed excitement about the acquisition, linking to their CEO’s blog post for more details, aligning with the positive media sentiment. Another X post from Beth Kindig (Beth Kindig X Post) on March 12, 2025, reiterated the deal’s details, noting W&B’s tools are used by enterprises like OpenAI and Meta, further supporting the strategic fit.

Potential Impacts and Future Outlook

The acquisition is poised to create a more integrated AI development ecosystem, combining CoreWeave’s infrastructure with W&B’s software layer. This could lead to more efficient AI development processes, potentially accelerating innovation, as both companies aim to help customers bring AI applications to market faster. The deal’s timing, ahead of CoreWeave’s IPO, is likely to positively influence its market perception, demonstrating growth and diversification.

For W&B, the acquisition ensures continued investment and resources, enabling further platform enhancements. The commitment to interoperability, as noted in the CoreWeave blog, is an unexpected detail that reassures customers about flexibility, potentially mitigating concerns about integration with existing workflows. This aspect, not always highlighted in acquisitions, could set a precedent for customer-centric mergers in the AI sector.

The acquisition of Weights & Biases by CoreWeave represents a significant step in consolidating AI infrastructure and development capabilities. With a valuation of $1.7 billion and an expected closure by mid-2025, the deal is poised to enhance innovation, supported by positive media reactions and a commitment to customer interoperability. This move, especially timely given CoreWeave’s IPO plans, underscores the dynamic growth in the AI sector, with potential long-term benefits for both companies and their customers.

W&B and Hugging Face

W&B and Hugging Face are related in that both serve AI developers, but their core functionalities and target audiences differ significantly:

- Relation: Both platforms are part of the AI development pipeline, with overlapping customer bases including AI engineers and organizations. Developers might use W&B for developing and fine-tuning models and Hugging Face for sharing and deploying them, indicating complementary roles in the AI workflow.

- Differences:

- Focus: W&B emphasizes experiment tracking, model management, and deployment monitoring, focusing on the development lifecycle. Hugging Face focuses on model sharing via its public hub and managed deployment services, such as Hugging Face Spaces.

- Model Sharing: W&B’s model sharing is primarily for internal team collaboration, not public sharing, whereas Hugging Face’s model hub is community-driven, allowing public uploads and downloads.

- Deployment: W&B provides tools for monitoring deployed models but does not offer its own deployment infrastructure, relying on integrations. Hugging Face offers a managed deployment platform, making it easier for users to host models via APIs.

- Business Model: W&B is more enterprise-focused, while Hugging Face balances open-source community engagement with commercial offerings, appealing to both researchers and businesses.

These differences highlight that while there is overlap in their customer base, their services cater to distinct stages of the AI model lifecycle, with W&B in development and Hugging Face in sharing and deployment.

Impact of CoreWeave’s Acquisition of W&B on Hugging Face

The acquisition of W&B by CoreWeave, an AI hyperscaler providing GPU computing power, integrates W&B’s software layer with CoreWeave’s infrastructure, potentially offering a comprehensive solution from development to deployment. This has several implications for Hugging Face:

- Potential Competition in Deployment: CoreWeave, with its infrastructure expertise, might enhance W&B’s capabilities to include deployment services on their cloud, integrated with W&B’s tools. This could compete with Hugging Face’s deployment offerings, such as Hugging Face Spaces, which provide managed model hosting. However, the competition is not direct, as Hugging Face offers a user-friendly, managed service, while CoreWeave’s deployment would be infrastructure-based, appealing to different customer needs (e.g., raw computing power vs. ease of use).

- Limited Impact on Model Sharing: W&B’s current focus is on internal model management and collaboration, not public model sharing, which is Hugging Face’s strength. Unless CoreWeave expands W&B to include a public model hub, Hugging Face’s community-driven model sharing business remains largely unaffected. Given W&B’s enterprise focus, this expansion seems unlikely in the short term.

- Customer Migration Potential: The acquisition might attract customers who prefer a seamless ecosystem for both development and deployment within CoreWeave-W&B, potentially reducing the need for Hugging Face’s deployment services. However, customers might still use Hugging Face for accessing a wide range of pre-trained models and for public sharing, indicating that migration would be partial and not comprehensive.

- Market Positioning: The integration of W&B with CoreWeave’s infrastructure could make their combined offering more attractive for enterprises seeking end-to-end solutions, potentially drawing some customers away from Hugging Face’s deployment services. However, Hugging Face’s unique position in the model sharing space, with its vast community and open-source ethos, differentiates it, suggesting the impact is likely minimal.

The businesses of Weights & Biases and Hugging Face are related through their service to AI developers but differ in their core offerings, with W&B focusing on development and management, and Hugging Face on sharing and deployment. The acquisition of W&B by CoreWeave may introduce some competition in deployment services due to potential integrated solutions, but Hugging Face’s model sharing hub remains unaffected. Research suggests the impact on Hugging Face is minimal, with its community-driven model sharing business continuing to stand out, while any competition in deployment is indirect and based on different customer needs.

So, in overall, it seems that while there is some overlap, particularly in deployment, the distinct offerings suggest the acquisition’s impact on Hugging Face is likely negligible at this point.

Key Sources

- CoreWeave and Weights & Biases to Join Forces CoreWeave Blog

- CoreWeave to Acquire Weights & Biases Industry Leading AI Developer Platform PR Newswire

- CoreWeave acquires AI developer platform Weights & Biases TechCrunch

- The Briefing by Martin Peers, Jessica Lessin and the team at The Information

- Weights & Biases to be Acquired by CoreWeave Orrick

- Nvidia-backed cloud firm CoreWeave to acquire AI developer platform Weights & Biases Reuters

- CoreWeave acquires AI developer platform Weights & Biases amid IPO prep PitchBook

- CoreWeave Acquires Weights & Biases in a 1.7 Billion AI Cloud Play Maginative

- IPO-bound CoreWeave to buy AI developer Weights & Biases for a reported 1.4B SiliconANGLE

- CoreWeave to Acquire Weights & Biases Ahead of its US IPO Debut analyticsindiamag.com

- CoreWeave acquires AI developer platform Weights & Biases TechCrunch

- IPO-bound CoreWeave to buy AI developer Weights & Biases for a reported 1.4B SiliconANGLE

- Weights & Biases Official Website

- Hugging Face Official Website